2021 electric car tax credit irs

In general fully electric vehicles can claim more of the credit than plug-in hybrid vehicles as their battery has more storage. In our example it zeros out.

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

The credit amount will vary based on the capacity of the battery used to power the vehicle.

. The amount is determined by the power storage of the battery. About Publication 463 Travel Entertainment Gift and Car Expenses. Line 14 Enter the number from line 11 of the worksheet.

Claiming the Federal Tax Credit. Otherwise late filing penalties might apply if you wait until. 2018 2019 2020.

A tax credit means an EV buyer will receive up to a 7500 reduction in their tax liability for the year. Line 15 Enter the lesser number of line 13 or 14 it depends on what your total tax bill is vs. Learn how Form 8834 can help you reap the tax benefits if youve purchased or used an electric car in a previous tax year.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. Ioniq Electric Battery Vehicle. Hybrid car tax credits work by giving you a nonrefundable credit on your income tax return.

Nissan is another car manufacturer to. IRC 30D Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. In that situation those families may be eligible to receive additional money by claiming the 2021 Recovery Rebate Credit on their 2021 income.

Department of EnergyThe total federal incentive amount depends on the capacity of the battery used to power your car and state andor local incentives may also apply. In 2021 the Luxury Car Tax threshold is 69152 for fuel efficient vehicles and 79659. 2021 Tax Return Forms and Schedules - January 1 - December 31 2021 - can be e-Filed beginning January 2022.

Tax Credits Explained. Notice 2009-89 New Qualified Plug-in Electric Drive Motor Vehicle Credit. The Internal Revenue Service IRS offers tax credits to owners and manufacturers of certain plug-in electric drive motor vehicles including passenger vehicles light trucks and two-wheeled.

Nissan Tax Credit. 2020 2021 2022 deduction Property Rental Tax Deciding to become a landlord can be highly beneficial for you financially. Notice 201367 Qualified 2- or 3-Wheeled Plug-In Electric Vehicle Credit Under Section 30Dg Notice 2016-15 Updating of Address for Qualified Vehicle Submissions.

The tax credit for new plug-in electric vehicles is worth 2500 plus 417 for each kilowatt-hour of battery capacity over 4 kWh and the portion of the credit. However buyers of Tesla cars will qualify for other local utility and state incentives. Do you qualify for the electric car tax credit.

Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. The tax credit now expires on December 31 2021. The IRS has been diligently introducing and maintaining tax credits to promote energy efficiency since 2008 when it added Section 30D to the Internal Revenue Code IRC.

Federal Tax Credit Up To 7500. Line 16 Find the difference between lines 15 and 13 to see if theres any credit to carry forward for next year. When you buy an electrified vehiclebattery electric vehicle BEV or plug-in hybrid electric vehicle PHEVmost people are entitled to a credit on your federal taxes.

Your total tax credits. If you purchased a new all-electric vehicle EV or plug-in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7500 according to the US. Ioniq 5 Electric Battery Vehicle.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Review the IRS credit for Qualified Plug-in Electric Drive Motor. 2021 Panamera 4 PHEV 4 E-Hybrid 4 E-Hybrid Sport Turismo 4 S E-Hybrid 4 S E.

The section is a provision for the Qualified Plug-In Electric Drive Vehicle tax credit first provided for by the Energy Improvement and Extension Act of 2008. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. At the start of 2020 a federal tax credit for electric cars stopped being available for any Tesla vehicle.

The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs. You have until October 15 October 17 2022 to e-File 2021 Tax Returns however if you owe taxes you should at least e-File a Tax Extension by April 18 2022. Electric vehicles produced after 2010 are eligible for an IRS tax credit from 2500 to.

This IRS tax credit can be worth anywhere from 2500 to 7500. But this is a flat credit which means it is only worth the full 7500 if the individuals tax bill is at least 7500. If an EV buyer has a tax bill of say 3000 at the end of the year the EV tax.

Have A New Electric Car Don T Forget To Claim Your Tax Credit Homeselfe

Electric Car Tax Credits What S Available Energysage

Pin On Daniel Moreno Custom Arbors Trellises

Pick Up A New Jaguar With Up To 7 500 Off

![]()

Building A Quality Pergola In Narre Warren Pergola Building A Pergola Garage Construction

What Is Irs Form 8910 Alternative Motor Vehicle Credit Turbotax Tax Tips Videos

Electric Vehicle Tax Credits What You Need To Know Doty Pruett And Wilson Pc

Image Result For Finance Loan Ad Banners Car Loans Finance Loans Bad Credit

Receive Up To 7 500 In Federal Tax Credit Towne Hyundai

Exactly How The Tax Current 7500 Ev Tax Credit Works Youtube

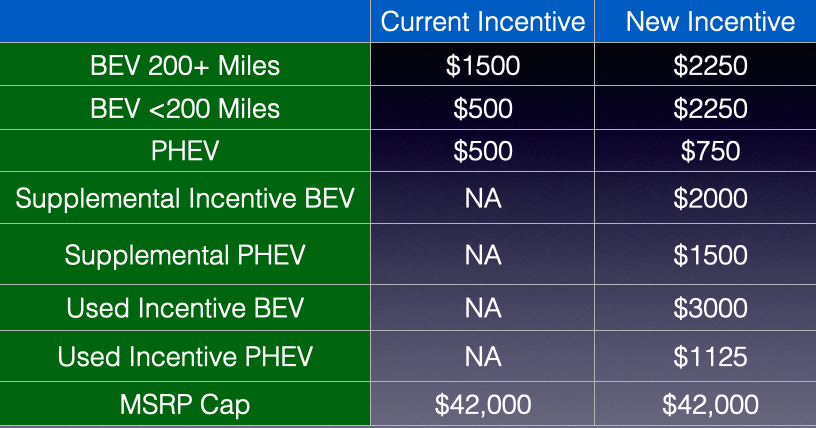

Federal And Connecticut Ev Purchase Incentives

Pick Up A New Jaguar With Up To 7 500 Off

Tax Credit For Electric Vehicle Chargers Enel X

Receive Up To 7 500 In Federal Tax Credit Towne Hyundai

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Four Questions You Should Ask Before Donating Your Car Capital One Auto Navigator

Have A New Electric Car Don T Forget To Claim Your Tax Credit Homeselfe

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Polestar Electric Vehicle Ev Tax Credit Guide Unstoppable Automotive Group