illinois payroll withholding calculator

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4.

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. 2022 Federal Tax Withholding Calculator.

Just enter the wages tax withholdings and other information required. This calculator is a tool to estimate how. The calculator on this page is provided through the adp.

Illinois Hourly Paycheck Calculator. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is. This is a projection based on information you provide.

Your employer will withhold money from each of. Instead you fill out Steps 2 3 and 4. Below are your Illinois salary paycheck results.

The state tax year is also 12 months but it differs from state to. Tax withheld 0495 x wages line 1 allowances x 2375 line 2 allowances x 1000 number of pay periods. This article will help you understand what you need to do to process Illinois payroll for your hourly workers.

Below are your Illinois salary paycheck results. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. The results are broken up into three sections.

Just enter the wages tax withholdings and other information required. Free Federal and Illinois Paycheck Withholding Calculator. 2022 Federal Tax Withholding Calculator 2022 Federal Tax Withholding Calculator.

Additional payroll withholding resources. See how your refund take-home pay or tax due are affected by withholding amount. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. This is a projection based on information you provide. This calculator is a tool to estimate how much federal income tax will be withheld.

All amounts are annual unless otherwise noted. This is a projection based on information you. Illinois Hourly Paycheck Calculator Results.

If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. Youll use your employees IL-W-4 to. Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use.

This is a projection based on information you provide. Estimate your federal income tax withholding. Free Federal and Illinois Paycheck Withholding Calculator.

Illinois Hourly Payroll Calculator. Paycheck Results is your gross pay and specific. Illinois Payroll Withholding Effective January 1 2022.

Tax withheld 0495 x wages line 1 allowances x 2375 line 2 allowances x 1000 number of pay periods. Use this tool to. The results are broken up into three sections.

How It Works.

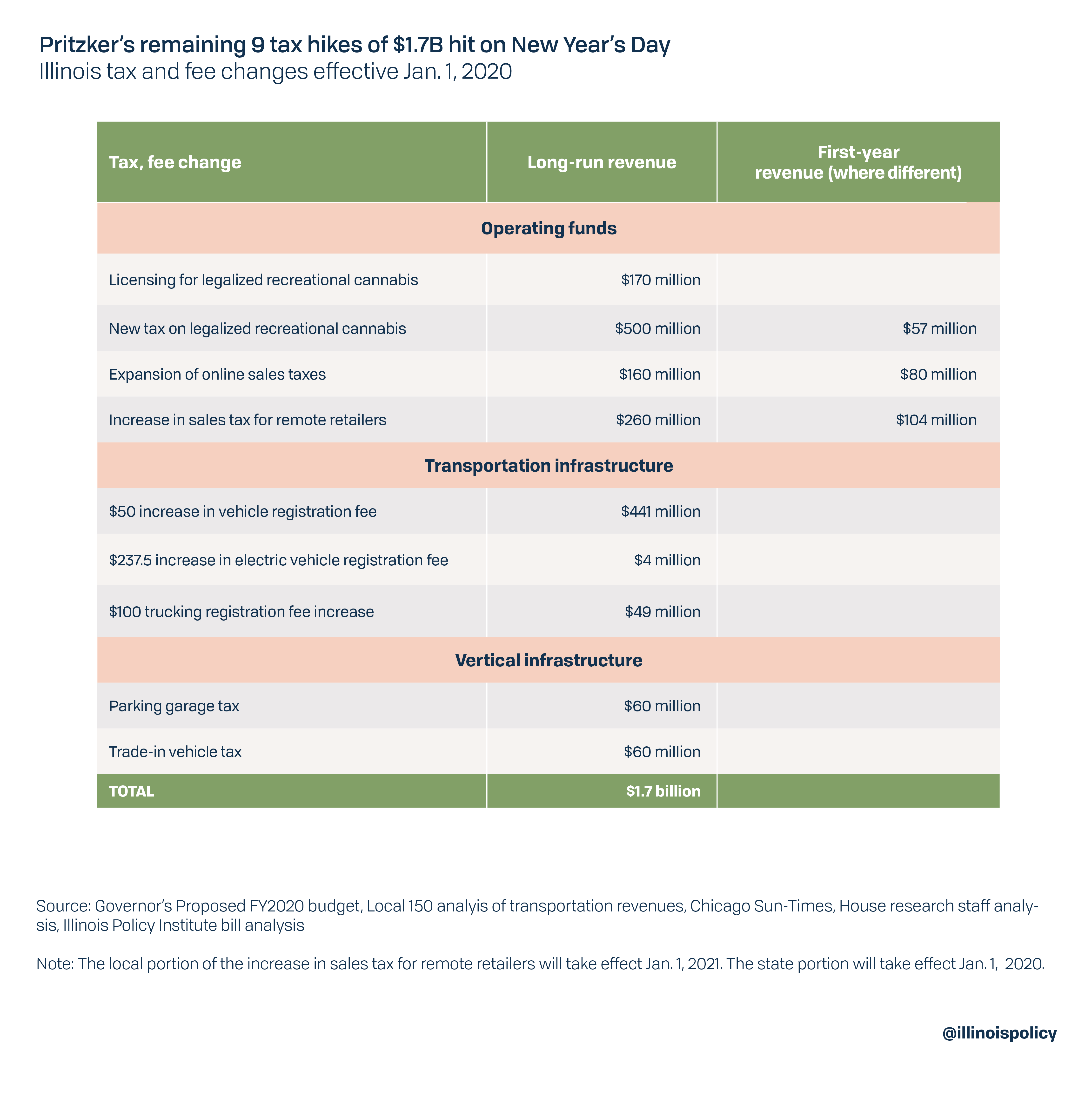

How Much Would You Pay In Illinois Income Tax Under Pritzker Plan Across Illinois Il Patch

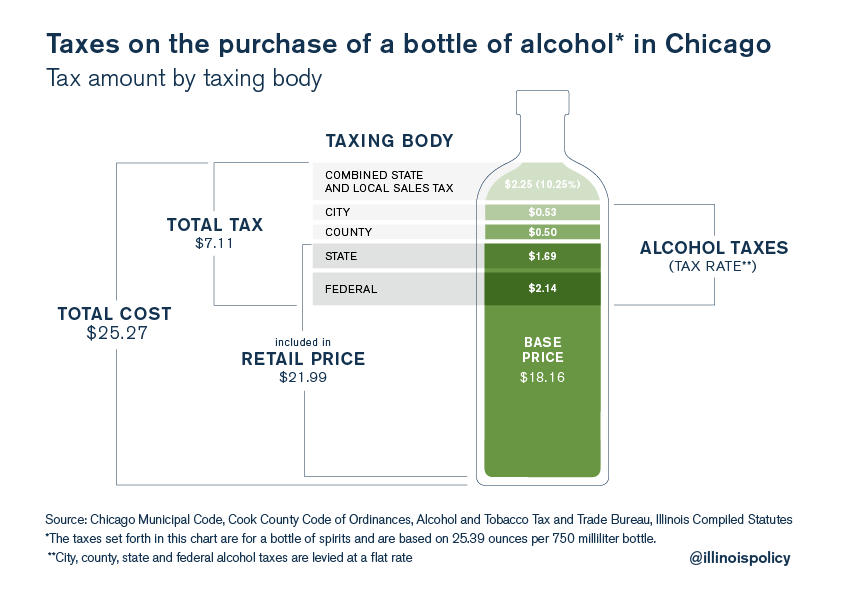

Chicago S Total Effective Tax Rate On Liquor Is 28

Illinois Sales Tax Small Business Guide Truic

The Illinois Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

Destination Based Sales Tax Assistance Effective January 1 2021 Sales Taxes

How To Calculate Payroll Taxes Methods Examples More

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

Here S How Much Money You Take Home From A 75 000 Salary

Illinois Paycheck Calculator Adp

Tax Withholding For Pensions And Social Security Sensible Money

Solved Turbotax Mailing Address For Illinois Incorrect

Dual Tax Status What Does It Mean For Your Pastor American Church Group Illinois

Paycheck Calculator Take Home Pay Calculator

New Tax Law Take Home Pay Calculator For 75 000 Salary

Illinois Payroll Tools Tax Rates And Resources Paycheckcity

State Individual Income Tax Rates And Brackets Tax Foundation