are hoa fees tax deductible for home office

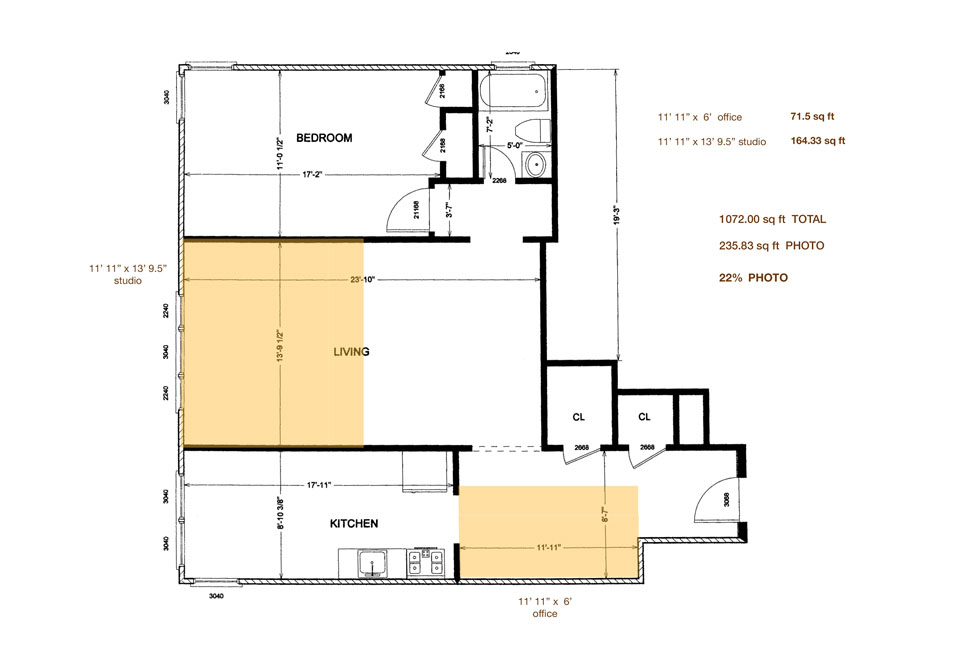

Any percentage used in conjunction with this business or office may be tax-deductible. For instance if you use 10 of your.

Do You Qualify For The Home Office Deduction Vero Beach Fl Accountant Kega Cpas

A Homeowners Association HOA is a governing body that sets specific rules and guidelines that you agree to abide by when you purchase property in a condominium gated.

. There are a few exceptions though. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. Unfortunately homeowners association HOA fees paid on your personal residence are not deductible.

If you claim 10 of your home is being used as your home office. With more people working from home than ever before some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next. When HOA Expenses Are Tax Deductible If you use part of your home as an office you can deduct part of your home expenses.

This rule also applies if you only have a small office in your home. Are HOA fees deductible. For example if the home office takes up 20 of your home you may claim 20.

So if your hoa dues are 4000 per year and you use 15 percent of your home as your permanent place of business you. TurboTax will help you determine the correct deduction. So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600.

If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities. However if you have an office in your home that you use in. Filing your taxes can be a financial burden.

However there are some exceptions to this rule. Before claiming your HOA fees you will have to determine how much space your home office takes up in your house. If the use of the home office is merely appropriate and helpful you cannot deduct expenses for the business use of your home.

However as you are now aware there are several exceptions. Fees are not in general tax-deductible. Generally if you are a first time homebuyer your hoa fees will almost never be tax deductible.

Yes HOA fees are deductible for home offices. If you work from home and meet the Internal Revenue Services definition of a home office you are entitled to write off a portion of your homes expenses if they correspond with your home. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

The amount you can deduct will depend on what percentage of the home your office takes up. If the home is a rental property then you can deduct the HOA fees as a rental expense. The amount you are allowed to deduct will be equal to the portion of your property used for a home office.

The IRS considers HOA fees as a rental expense which means you can write them off from. For example if your home office only takes up 12 of your house then you. The IRS considers HOA fees as a rental expense which means you can write them.

For any home office to be deductible you must. How much can you write off.

Home Office Tax Deduction How Does It Work Sofi

Are Hoa Fees Tax Deductible The Handy Tax Guy

2022 Tax Deductions And Credits For Household Expenses Smartasset

Qualifying For The Home Office Deduction Dalby Wendland Co P C

Are Hoa Fees Tax Deductible The Handy Tax Guy

Are Hoa Fees Tax Deductible In California Hvac Buzz

Who Can Claim Home Office Tax Deduction If They Worked From Home

Are Hoa Fees Tax Deductible In California Hvac Buzz

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

How To Claim The Home Office Deduction With Form 8829 Ask Gusto

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Form 8829 For The Home Office Deduction Credit Karma

Are Hoa Fees Tax Deductible Complete Guide Hvac Buzz

What Is A Homeowners Association And How Much Are Hoa Fees Windermere Real Estate

A Guide To Tax Deductions For Home Based Business